Award-winning PDF software

How to prepare Form DS-11

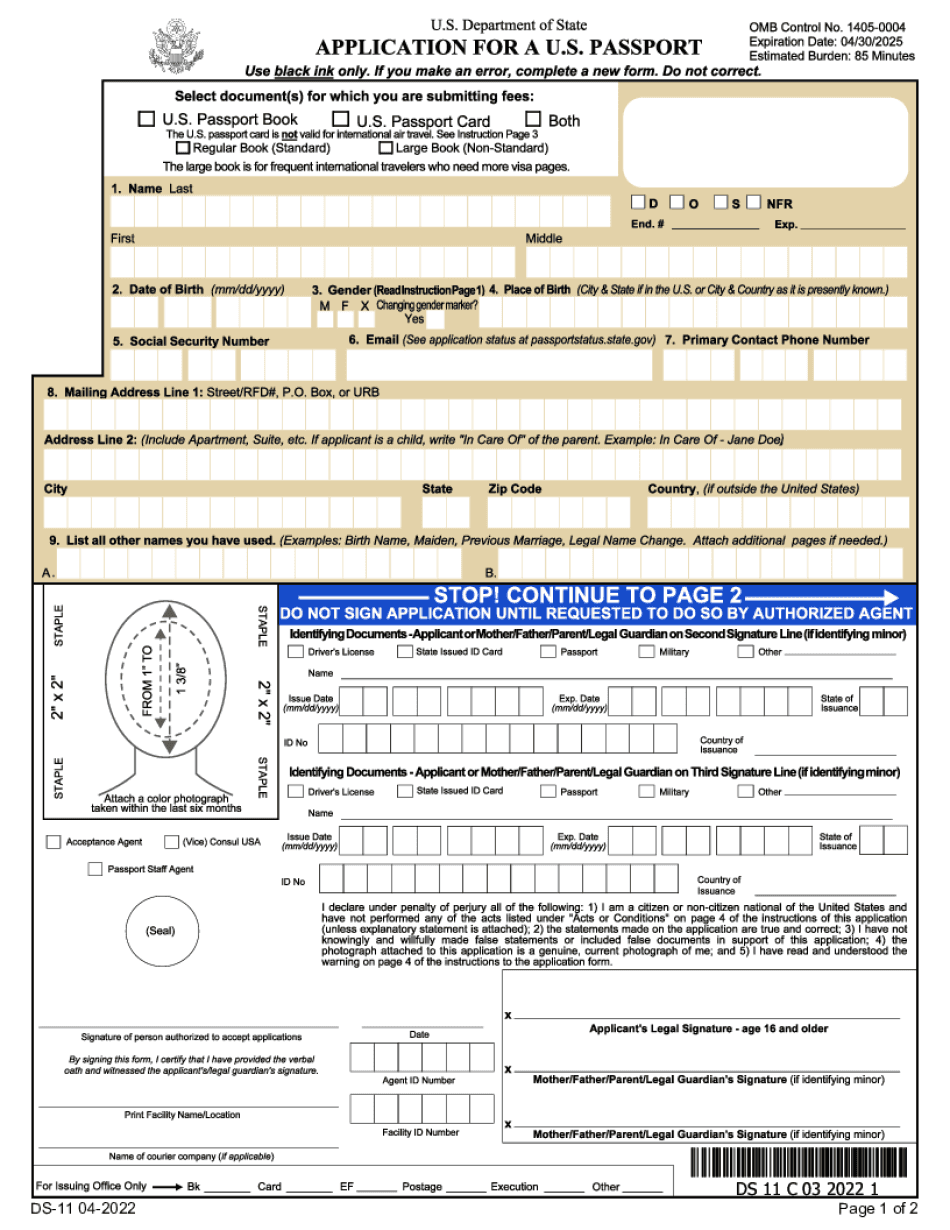

About Form DS-11

Form DS-11 is an application form used by the United States Department of State for individuals who are applying for a new U.S. passport. It is available for both adults and minors (under the age of 16). Anyone who is applying for their first U.S. passport, replacing a lost or stolen passport, renewing an expired passport issued more than 15 years ago, or renewing a passport issued to them when they were under the age of 16 needs to complete and submit Form DS-11. Additionally, individuals who have not held a U.S. passport for more than 15 years or their previous passport was issued before the age of 16, are required to use Form DS-11. This form provides the necessary personal information, identification details, and declarations required to process the passport application.

What IS Passport Application?

DS-11 is an Application Form for New U.S. Passport. It is usually filled out by the US citizens who need to replace a stolen Passport, receive a first-time Passport or renew a Passport issued to an under-age up to 16. First you need to download an appropriate printable sample and complete it according to specified instructions and requirements in order to provide acceptance of application. In order a form to be successfully processed, an applicant has to prtrue and correct information. Pay attention that you will be required to attach some additional documents to form DS-11, such as:

-

document which certifies the citizenship;

-

identity document;

-

recent color photo.

An applicant has to submit a form beforehand taking into account time for document processing. Check if all empty boxes are filled out and then submit a complete New Passport Application to a local agency. Don`t sign a document before filing if it is not required by an authorized agent. On this website you may find free updated form templates. Save your time and fill one of appropriate fillable forms online or print it and fill out manually at your option. We have made the application forms available here in PDF format which easily can be exported to Word.

Online remedies help you to arrange your document administration and boost the productiveness within your workflow. Comply with the short handbook to be able to total Form DS-11, keep clear of mistakes and furnish it inside a well timed fashion:

How to complete a Ds 11?

- On the web site along with the variety, simply click Commence Now and move with the editor.

- Use the clues to complete the applicable fields.

- Include your own information and facts and call knowledge.

- Make certain that you choose to enter appropriate information and facts and figures in correct fields.

- Carefully look at the material within the sort also as grammar and spelling.

- Refer that will help part should you have any queries or tackle our Assist group.

- Put an digital signature on the Form DS-11 using the help of Signal Tool.

- Once the form is done, push Performed.

- Distribute the ready sort through email or fax, print it out or help save with your device.

PDF editor lets you to definitely make alterations towards your Form DS-11 from any net related device, personalize it in accordance with your needs, indication it electronically and distribute in different methods.